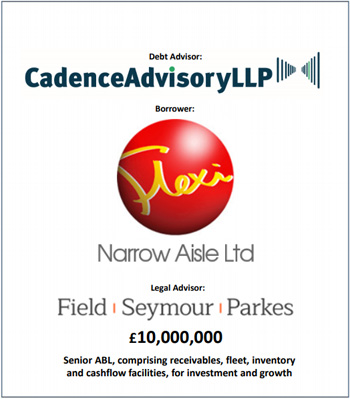

Donald Houston,

CFO: Narrow Aisle Limited

“Cadence provided excellent

support to the senior

management team in all aspects

of the facility, including collateral

evaluation, financial modelling

and covenant structure.

Cadence were fundamental in

negotiating the legals, ensuring

that agreed documents fully

reflected the technicalities in the

business, and importantly, that

management fully understood the

mechanics of the facility and

processes around completion”

Jim Porter,

Chairman: Narrow Aisle Limited

“The momentum in our sector is

strongly positive as countries

develop intralogistics capabilities

around the world. Cadence

Advisory structured and sourced

a very flexible funding package,

releasing the value from our

complex asset base, which

ensures that the business is well

positioned to meet the global

growth.

The team at Cadence worked

with and co-ordinated a large

number of stakeholders,

including providing considerable

support through the legal

process. I would not hesitate to

endorse them to any business

exploring asset based solutions.”

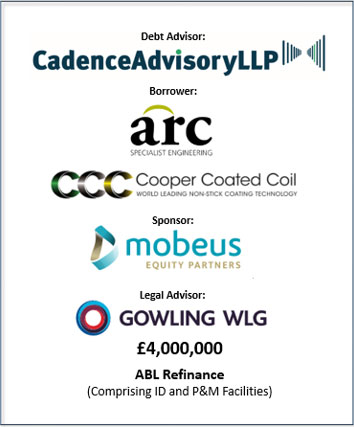

Kevin Tranter, CFO:

“Following the Mobeus-backed buyout in 2016, we were keen to optimise the flexibility in our debt facilities in order to better manage the new capital structure and maximise our liquidity. Cadence produced a detailed review of the business, including detailed analysis of the receivables, and demonstrated a thorough understanding of the UK ABL market to deliver a well-structured and cost effective secured-debt solution.

Our ABL facility fully unlocks the value of our significant export receivables, as well as the cash tied up in our fixed assets.”

Richard Babington, Mobeus:

“Cadence provided Mobeus with strategic debt advice throughout the acquisition of the Arc Group, and we subsequently engaged them to oversee the refinance of the Group.

Working in partnership with management and Mobeus, Cadence devised a detailed debt structure which fully meets the requirements of the Group, as well as enabling us to service our loan notes.

The team at Cadence managed the entire process, including co-ordinating all third party inputs and lender negotiations, and delivered an excellent solution for the business.”

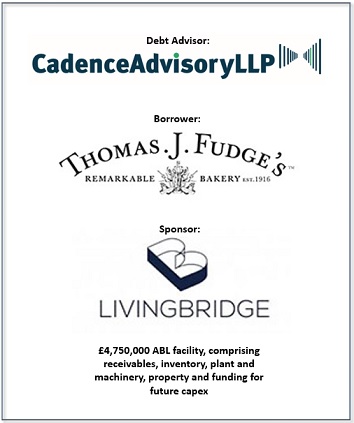

Emma Davies, FD, Dorset Village Bakery:

“Cadence were proactive and very effective in managing the practicalities of obtaining and comparing a range of competing offers. They offered insight and expertise in assessing the commercial considerations and business priorities in selecting the funding.

During the legal negotiations their expertise and experience was hugely helpful in ensuring the deal was completed on time and in scope – particularly in dealing with difficult, technical points. Most importantly, they became a trusted adviser over the course of the engagement.”

Benoit Broch,Livingbridge:

“In a fast changing market it is a great benefit to be able to use the dedicated and high focussed team at Cadence to make sure we get the best deal in the market and our management teams get excellent technical and practical support which allows them to retain their focus on running the business.”

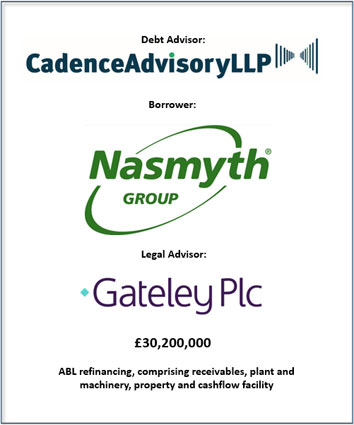

Paul Jones, Group CFO: Nasmyth Group

“The team at Cadence were instrumental in structuring and obtaining a secured ABL funding package for the Nasmyth Group in order to support its growth and investment strategy both domestically and internationally.

Cadence worked closely with Nasmyth in structuring business financial models in support of the covenant structure and headroom. They also worked closely with senior management and all stakeholders, including our legal advisors, to ensure the documented deal structure fully matched the lender’s offer and met the changing needs of the Group.”

Peter Smith, Chairman & CEO: Nasmyth Group

“In order to meet the future growth aspirations of the Group, both in the UK and overseas, we took the decision to refinance our previous ABL facilities with a more flexible business partner.

Cadence were highly knowledgeable, and offered tremendous support to the management team in negotiating a solution that fully meets our current and future borrowing requirements. Cadence were invaluable in advising and providing comfort at every stage of the process.”

Michael Norris – Group FD:

“The management team were unfamiliar with ABL, so we were wholly reliant on Cadence to guide us through the refinancing.

Early in the process, Cadence identified and highlighted the complexities in the debtor book, devised a funding and covenant structure and sourced a number of underwritten offers from prospective lenders. Cadence fine tuned these offers and were able to obtain the most flexible structure at the lowest cost.

The Cadence team ensured that the legal documents fully reflected the lender terms, and supported both our legal advisors and the management team through the mechanical and operational aspects of the debt facilities.”

Richard Babington – Mobeus:

“Mobeus supported the MBO of Kinneir Dufort in September 2016 with a single combined debt and equity funding solution.

More recently, we engaged Cadence to source a cost-effective ABL facility which would allow for the restructure of the balance sheet and enable us to optimise the servicing of the Mobeus notes.

Cadence negotiated with a number of lenders to maximise liquidity whilst minimising cost and covenant impact.

Cadence have proven themselves in forging trusted relationships with management and sponsors alike.”